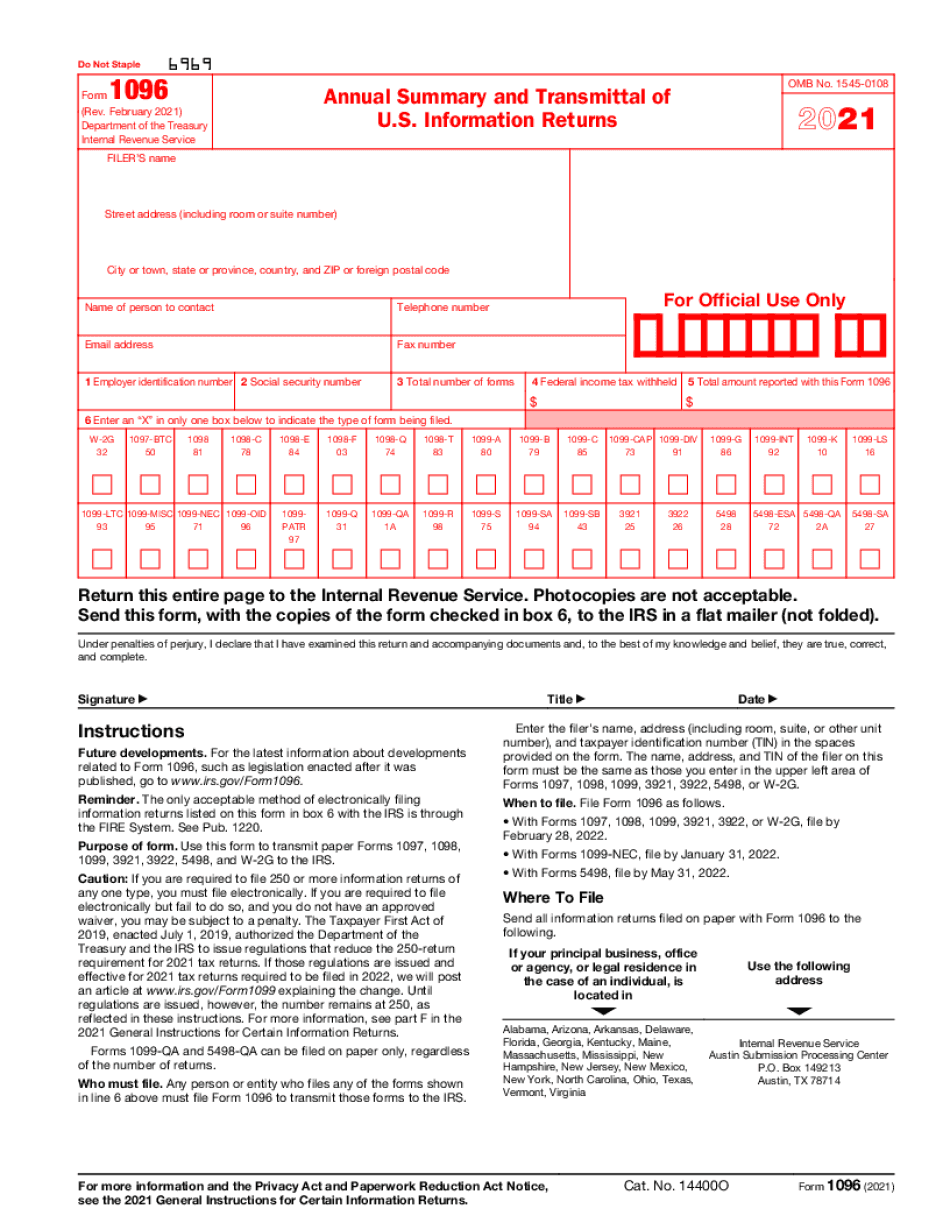

Take our lead, let's help you make your mark. Our goal is your satisfaction, so let us guide you in the right direction. - You must mail or hand Form 1099-MISC Copy B and Form 1099-MISC Copy 2 to each independent contractor, partnership, or LLC by January 31st. - Additionally, you need to mail Form 1096 along with the accompanying 1099-MISC Copy of forms to the IRS by February 28th. - If you need to send a corrected form to the recipient, don't forget to prepare the red copy A to be sent to the IRS with the Form 1096 transmittal. - However, if you are filing electronically, you do not need to send in a Form 1096, nor should you send the originally filed forms with the correction to the IRS. - To summarize all of your 1099 filed, file one Form 1096 Annual Summary and Transmittal of U.S. Information Returns for each different type of your 1099. For example, file one 1096 to summarize all of your 1099 miscellaneous and another one for all of your 1099 interest or dividends. - Lastly, make sure to mail the 1096 and 1099 forms together in the same envelope. Thank you for watching! Please subscribe and hit the bell notification.

Award-winning PDF software

How to prepare 1096 Form 2021

1

Complete the papers

Proceed through each of the fields within our professional editor. Put in the necessary information in outlined places and double-check it.

2

Signal the shape

Click on the Signature area (if available) or pick the Sign tool in the top toolbar. Make the e-signature inside your desired way.

3

Keep or deliver the template

As soon as your 1096 Form 2024 is completed, pick Done to access the export menu. Keep your document in a required format or send out it to the beneficiary right from the service.

Get 1096 Form 2024 and make simpler your day-to-day document management

- Find 1096 Form 2021 and start editing it by clicking Get Form.

- Begin filling out your form and include the details it requires.

- Make the most of our extended editing toolset that allows you to add notes and leave comments, if necessary.

- Take a look at form and double-check if the information you filled in is correct.

- Easily correct any error you made when modifying your form or return to the previous version of the document.

- eSign your form easily by drawing, typing, or capturing a picture of the signature.

- Save adjustments by clicking Done and after that download or distribute your form.

- Send your form by email, link-to-fill, fax, or print it.

- Select Notarize to do this task on your form online with the eNotary, if required.

- Securely store your approved file on your PC.

Modifying 1096 Form 2024 is an simple and intuitive procedure that needs no prior coaching. Discover everything that you need in a single editor without the need of constantly switching in between different platforms. Find much more forms, fill out and save them in the file format of your choice, and simplify your document management within a click. Prior to submitting or sending your form, double-check information you provided and quickly correct mistakes if required. In case you have questions, get in touch with our Support Team to assist you.

Video instructions and help with filling out and completing 1096 Form 2024